GENERAL INFORMATION

- Overview

- HDBank’s subsidiaries

- Primary business lines, business locations, and provincial network

- History of establishment and development

- Financial growth over the years (2021, 2022, 2023)

- Business environment, opportunities, risks and challenges

- Economic outlook year 2024

- HDBank’s risk management

- Strategic development goals in the 2021 - 2025 period

- Goals, directions, and business plan 2024

- HDBank’s goals in 2024

- Medium and long-term goals and orientation

- Outstanding milestones and awards

OVERVIEW

| Name in Vietnamese: | NGÂN HÀNG THƯƠNG MẠI CỔ PHẦN PHÁT TRIỂN THÀNH PHỐ HỒ CHÍ MINH |

| Name in English: | HO CHI MINH CITY DEVELOPMENT JOINT STOCK COMMERCIAL BANK |

| Abbreviated name: | HDBank |

| Business Registration Certificate | No. 0300608092 issued by Ho Chi Minh City Department of Planning and Investment, 1st registered on August 11, 1992 and 33rd amended on September 5, 2023 |

| Current charter capital: | VND 29,076 billion |

| Owner’s equity: | VND 46,400 billion |

| Head Office: | No. 25Bis Nguyen Thi Minh Khai Street, Ben Nghe Ward, District 1, Ho Chi Minh City |

| Tel: | (84-28) 6291 5916 |

| FAX: | (84-28) 6291 5901 |

| Website: | www.hdbank.com.vn |

| License of Establishment and Operation: | No. 26/GP-NHNN issued by the State Bank of Vietnam dated February 12, 2020 and Decisions amending and supplementing License of Establishment and Operation No. 26/GP-NHNN dated February 12, 2020 |

| Logo: |

|

| Ticker: | HDB |

HDBANK’S SUBSIDIARIES

HD SAISON FINANCE CO., LTD. (HD SAISON)

Address:

8-9-10 Floor, Gilimex Building, 24C Phan Dang Luu Street, Ward 6, Binh Thanh District, Ho Chi Minh City, Vietnam.

Charter capital:

VND 2,350 billion

Ownership ratio:

50%

History of establishment:

HD SAISON Finance Co., Ltd. (“HD SAISON”), originally known as Société Générale Viet Finance Co., Ltd. (“SGVF”) and wholly owned by Société Générale S.A., underwent a change in ownership when Société Générale S.A. transferred its entire equity stake in SGVF to the Ho Chi Minh City Development Joint Stock Commercial Bank (“HDBank”). Subsequently, SGVF was renamed to Ho Chi Minh City Development Joint Stock Commercial Bank Finance Co., Ltd. (“HDFinance”).

After receiving approval from the State Bank of Vietnam, HDBank successfully transferred 49% of HDFinance’s charter capital to Credit Saison Co., Ltd. and 1% to Ho Chi Minh City Securities Corporation. Consequently, HDFinance transitioned from a one-member limited liability company to a multi-member limited liability company and officially changed its name to HD SAISON Finance Co., Ltd.

Products and services:

HD SAISON offers consumer loan products, including installment loans for transport vehicles, household appliances, furniture, tuition fees, beauty and dental care, weddings, travel, sports and fitness, as well as cash loans for personal use.

In addition, the HD SAISON mobile application, available on both popular operating systems, iOS and Android, enables clients to apply for such loans entirely online with just a few taps on their phone screens.

In addition, HD SAISON issues HD SAISON VISA international credit card embedded with contactless payment EMV chip, bringing a new experience to customers with a modern, fast and highly secure payment method.

Transaction points as of December 31, 2023:

24,234 transaction points in 63 cities and provinces nationwide.

PRIMARY BUSINESS LINES, BUSINESS LOCATIONS, AND PROVINCIAL NETWORK

HDBank was established and operated under Decision No. 47/QD-UB of the People’s Committee of Ho Chi Minh City dated February 11, 1989 and License No. 26/GP-NHNN issued by the State Bank of Vietnam dated February 12, 2020 (replacing License No. 00019/NH-GP of the State Bank of Vietnam dated June 6, 1992).

The Bank was established in order to perform all activities allowed for a commercial bank under applicable laws, including: mobilizing and receiving short, medium and long-term deposits from organizations and individuals; offering short, medium and long-term loans to organizations and individuals based on types and sources of its funds; providing bank guarantees; factoring invoices; issuing credit cards; offering foreign currency transactions; providing foreign exchange services, derivative products in the domestic and international markets, international trade finance support services, discounts of commercial papers, bonds and other valuable papers, and insurance agency services, opening payment accounts; providing payment services, corporate finance consulting services and other banking services permitted by the State Bank of Vietnam.

BUSINESS LOCATIONS

01

Head Office in Ho Chi Minh City

01

Representative Office in Hanoi

01

Representative Office in Myanmar

352

branches and transaction offices nationwide.

HDBank’s wide domestic operation network enables HDBank and its member units to reach out to customers in all 63 provinces and cities nationwide, providing a wide range of banking and consumer finance products and services to a diverse range of customers.

| LOCATIONS | QUANTITY OF BRANCHES AND TRANSACTION OFFICES |

|---|---|

| Ho Chi Minh City | 61 (Head Office included) |

| Hanoi | 56 (Northern Representative Office included) |

| North | 76 |

| Central | 40 |

| Southeast - Central Highlands | 75 |

| Southwest | 46 |

| Myanmar | 01 Representative Office |

HISTORY OF ESTABLISHMENT AND DEVELOPMENT

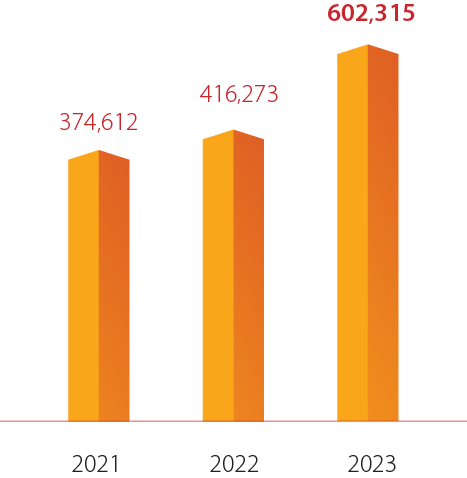

FINANCIAL GROWTH OVER THE YEARS (2021, 2022, 2023)

Total assets

Unit: VND billion

HDBank’s total assets reached VND 602,315 billion for the first time, growing by 44.7% compared to 2022 and the latest 10-year CAGR was 21.5%.

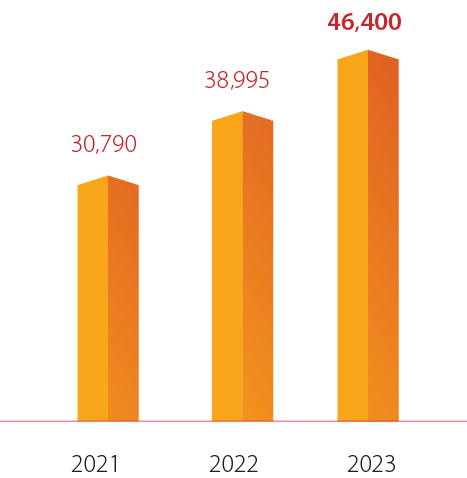

Owners’ equity

Unit: VND billion

Owners’ equity increased by 19.0% compared to 2022, of which charter capital increased by 14.9% and the latest 10- year CAGR was 18.4%.

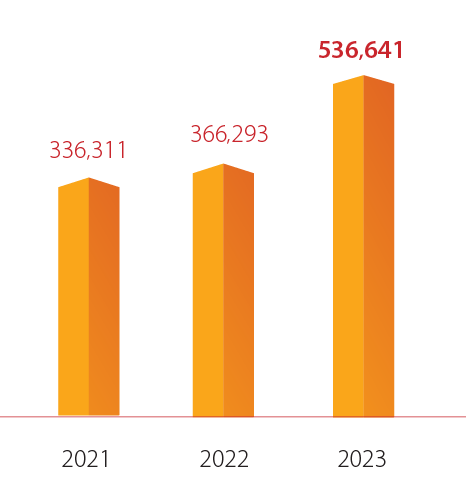

TOTAL DEPOSITS

Unit: VND billion

The total deposits increased stably by 46.5% compared to 2022 and the latest 10-year CAGR was 21.5%

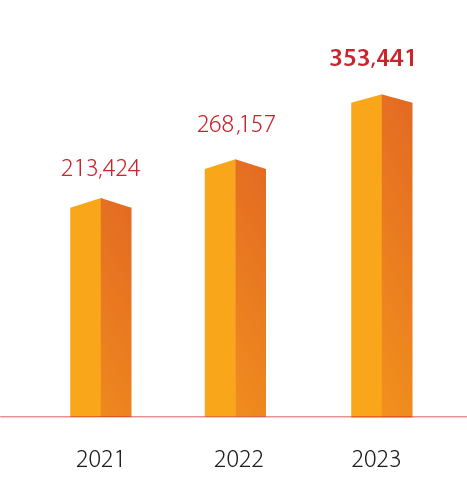

TOTAL OUTSTANDING CREDIT

Unit: VND billion

The total outstanding credit increased remarkably by 31.8% compared to 2022 and the latest 10-year CAGR was 21.8%

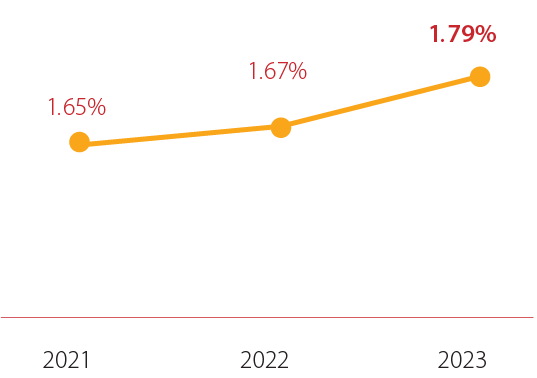

Non-performing loan ratio

Unit: %

The consolidated NPL ratio is effectively controlled below 2% and HDBank’s separate NPL ratio in 2023 was recorded at a low level of 1.51%.

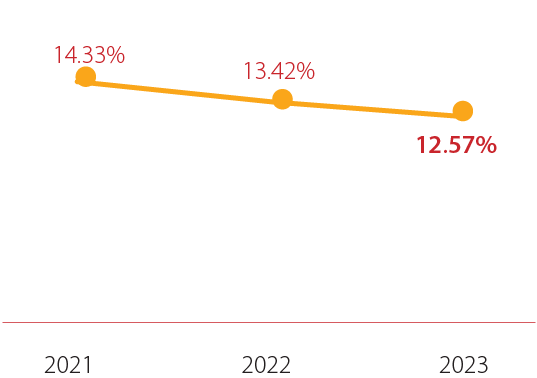

Capital adequacy ratio (CAR) (Basel II)

Unit: %

HDBank’s CAR (Basel II) is always managed at a high level over to the State Bank’s regulatory threshold (8%). Notably, HDBank is also one of the first banks in Vietnam to have completed full implementation of Basel III requirements, affirming HDBank’s solid risk management foundation in operations, meeting international standards, enhancing the Bank’s reputation and competitiveness in the market.

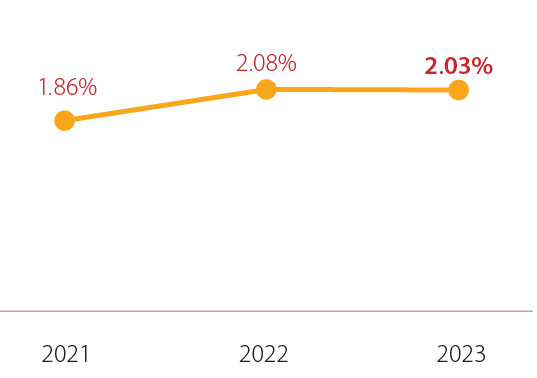

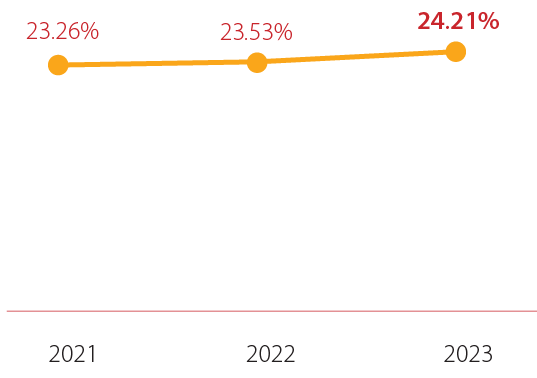

PROFITABILITY RATIO

The profitability ratio was high and sustainable, enabling HDBank to bring the best benefits to shareholders and remain at the forefront of the industry. The 10-year CAGR for ROAA was 20.6% and 22.8% for ROAE.

ROAA

Unit: %

ROAE

Unit: %

BUSINESS ENVIRONMENT, OPPORTUNITIES, RISKS AND CHALLENGES

Under the influence of a tightening cycle of such unprecedented scale and speed to combat inflationary pressures, the global economy in 2023 faced significant growth pressures in an uncertain macroeconomic environment. According to World Bank forecasts, overall global growth is expected to reach merely around 3% in 2023, compared to 3.5% in 2022 and 3.8% in the 2000- 2019 period. Inflation is expected to continue improving, averaging 6.9%, but will not return to target levels until 2025 in most economies. Some of the financial market hotspots in 2023 included the banking crisis in a number of major economies, the Federal Reserve’s (FED) interest rate plateau at high levels for an extended period, the impact of the real estate sector in China, sluggish economic growth in European countries, and escalating geopolitical risks between Russia and Ukraine, as well as Israel and Hamas, which have significantly slowed down the international trade and investment flows in 2023.

As a highly open economy heavily reliant on exports, imports, and foreign investment, Vietnam faced numerous challenges in 2023, such as weakening consumer demand in key partner economies, and slower foreign direct investment (FDI) growth compared to past years due to heightened risk aversion and business expansion difficulties, which significantly dampened the economy’s capital absorption needs.

To adapt and overcome these challenges, the Government and the State Bank of Vietnam implemented proactive and flexible monetary policies in close coordination with fiscal and other policies. These measures ensured the safety and liquidity of the system, contributed to macroeconomic stability, controlled inflation, maintained major economic balances, and created momentum for rapid and sustainable development. In 2023, the average GDP growth reached 5.05%, driven by the service and industrial and construction sectors. Within the 2011-2023 period, the GDP growth rate in 2023 only outperformed the rates of 2.87% and 2.55% recorded in 2020 and 2021, respectively, highlighting the substantial impact of the global interest rate tightening cycle on the Vietnamese economy. Other growth drivers included the Government’s strong political determination to accelerate public investment disbursement, the robust recovery of FDI inflows under the influence of the China +1 strategy, and the resurgence of domestic tourism. Inflation in 2023 remained well-controlled, increasing by only around 3.3% compared to the target of 4.5%, primarily due to the downward trend in global oil prices in the latter half of 2023. According to data from the State Bank of Vietnam: The Vietnamese Dong (VND) depreciated by only about 2.2%, while other Asian domestic currencies depreciated by 5-10% compared to the USD. The credit growth rate was around 13.7%, and mobilization increased by around 14% compared to the end of 2022. Interbank market liquidity remained stable and abundant. Efforts are underway to actively address bottlenecks in the corporate capital market and the real estate sector.

ECONOMIC OUTLOOK YEAR 2024

The global fight against inflation is no longer the main focus as most major central banks signal a shift towards monetary policy easing in the second half of 2024, in response to timely signs of a downward trend in consumer price indexes and mounting pressure on economic growth, which is almost on the brink of a recession. In 2024, the World Bank forecasts that global growth will remain subdued, with the lagged effects of the tightening measures implemented in 2023 and the first half of 2024 continuing to weigh on economic activity. The average growth rate is projected to hover around 2.9%, while global inflation is expected to increase by around 5.8% compared to 6.9% in 2023. The coordinated monetary policy easing by Central Banks of major economies is likely to boost aggregate demand for goods, improve market sentiment, and increase capital flows to emerging markets. Large-scale fiscal stimulus packages targeting specific economic sectors in China, and resolute policy support for the domestic real estate market are expected to be the driving force behind the overall global economic growth in 2024.

For Vietnam, the National Assembly has set economic growth target of around 6-6.5% and an inflation target of around 4-4.5% for 2024. Accordingly, the Government and the State Bank of Vietnam are expected to continue implementing proactive and flexible monetary policies in close coordination with fiscal and other policies. These measures are expected ensured the safety and liquidity of the system, contributed to macroeconomic stability, controlled inflation, maintained major economic balances, and created momentum for rapid and sustainable development. In addition, public investment disbursement is expected to be further accelerated in 2024 through key infrastructure projects, and the strengthening of comprehensive strategic partnerships with major economies such as the United States and China, is expected to significantly improve the overall economic outlook and investment flows into Vietnam.

Alongside the economy’s opportunities and challenges, the Banking sector continues to face numerous growth prospects in 2024 while also confronting unavoidable risk factors.

Balancing monetary policy to control inflation, ensure sustainable economic growth, maintain financial market stability, and guarantee major economic balances poses one of the most significant challenges for the State Bank of Vietnam and the Banking sector. Despite these challenges, there are numerous opportunities for the Banking sector for sustainable and effective development.

Specifically, the Banking sector has consistently implemented, improved, and ensured compliance with international financial regulations and banking governance standards to adapt to the fluctuations and changes in the global financial market. In addition, banks are heavily investing in upgrading and perfecting the new technology infrastructure, not only to ensure information security but also to implement digital transformation to automate business processes, provide digital banking products and services, enhance service quality, and improve customer convenience and experience.

HDBANK’S RISK MANAGEMENT

In 2023, HDBank continued to maintain a good internal control system, with the 3 pillars of Basel II and in compliance with Circular 41 and Circular 13, including: CAR calculation according to Basel (Pillar 1), application of the internal capital adequacy assessment process (ICAAP) (Pillar 2), and transparency of information (Pillar 3). HDBank is aiming to adopt the International Financial Reporting Standard (IFRS 9) in the period 2024-2025 with advice from leading consulting companies in the market.

The prudential ratios of HDBank are always strictly managed within the limits prescribed by the State Bank. The capital adequacy ratio CAR reached 12.6%. The separate nonperforming loan ratio reached 1.51%. The ratio of shortterm funds used for medium and long-term loans is 22.5%, lower than the prescribed level of 30%. The loan to deposit ratio is 66.2% compared to the maximum limit of 85%.

In addition, HDBank also continued to further improve the internal control system, capital capacity, and risk management capability through the implementation of Basel III (with advice from a leading consulting company), with the direction of becoming one of the banks in Vietnam with a modern, healthy and sustainable risk management system, committed to the highest benefits for its customers.

For Operational Risk Management, HDBank has completed a comprehensive Operational Risk Management Framework with advice from a leading consulting company in the market. The system provides tools to effectively identify, measure, monitor and manage operational risks, proactively detect early warning signs of risks to take timely operational risk management measures.

For Environmental and Social Risk Management, in 2023, HDBank has issued Regulations on Environmental, Social, Governance (ESG) and Regulations on Environmental and Social Risk Management in credit granting activities to enhance its sustainable operations in customer service and partner collaboration. This emphasizes HDBank’s commitment to respecting human life, creating a positive impact on the environment and complying with laws and international standards. HDBank is also committed to supporting small and medium-sized enterprises (SMEs) through integrating ESG (Environment, Social and Governance) sustainable development goals into overall business development goals. This will contribute to the green transition and sustainable growth of the economy.

In 2023, HDBank continued to organize training courses to improve the knowledge of risk management, update on new regulations and enhance risk management awareness from management to employees.

HDBank has implemented an Internal Control System in accordance with Circular 13 of the State Bank, and the Basel Standard: applying the three (3) lines of defense and the five (5) key activities in the following model:

- The system of regulations, limits, and prudential ratios is continuously to be developed and completed by the bank. The system of regulations is organized into three levels: Regulations (issued by the Board of Directors to set general policies and directions), Policies and Guidelines/Products (issued by the Chief Executive Officer and implemented appropriately from time to time), encompassing all activities to standardize operations and ensure safety for the bank.

- Since 2013, the bank has successfully implemented a quality management system according to ISO 9001:2008, which was successfully upgraded to the latest version in 2018, and the 5S standard (Sort, Set in order, Shine, Standardize, and Sustain).

- In addition, the bank regularly establishes and adjusts its system of limits related to credit transactions, money market transactions, investments, and prudential ratios related to liquidity, asset and liability management, etc., in accordance with the regulations of the State Bank of Vietnam and in line with HDBank’s operations.

- HDBank places special emphasis on its remote control, monitoring, and inspection system as a basis for detecting, warning, and preventing risks before, during, and after transactions.

- The system applies multiple methods simultaneously: automatically through the IT system, periodically performed by specialized control departments, or immediately on each transaction, in which HDBank has monitored suspect transactions (if any) on-site.

- Reports on the results of monitoring and actual inspection with specific data, analysis, warnings, and proposals are sent in a timely manner to the Board of Management and the Board of Directors for appropriate and timely processing instructions.

HDBank has established a strict credit granting system throughout the organization, from headquarters to business units, including all departments at all stages: sales, appraisal, approval, disbursement, and debt collection. The credit granting process is applied independently at the proposal, appraisal/valuation, and approval stages, clearly defining the steps and responsibilities of each involved party.

HDBank has also established strict regulations on credit granting, collaterals, and limits on loan structure by industry, purpose, type of collateral, etc. to mitigate concentrated risks.

In 2023, HDBank has completed the consulting project to upgrade from Basel II to Basel III. By aiming to meet Basel III standards, the bank achieves a dual benefit: compliance with the State Bank regulations and an upgrade of its risk management framework, particularly in liquidity, interest rates, and market aligning with international practices.

With a focus on digital transformation, the bank continues to deploy Asset and Liability Management (ALM) software and fund transfer pricing (FTP) management system in 2023. This system allows the Bank to manage risks of liquidity, daily interest rate, and balance sheet forecast, enhancing the efficiency of Asset and Liability Management, optimizing profits, while ensuring compliance with regulations and risk limits.

Additionally, monitoring and warning of limits in foreign exchange trading and securities investments are regularly and strictly carried out to ensure compliance with the prudential ratios for liquidity and operations as prescribed in the State Bank regulations.

In response to fluctuations in exchange rates, interest rates, bonds, and so on, in 2023, HDBank conducted a number of stress tests on market risk and liquidity risk, which showed that HDBank still continue to ensure effective and safe operations.

In 2023, HDBank completed a consulting project to implement an Operational Risk Management Framework in line with RC2 initiative of Strategy 35-53 according to BCG’s advice on building a proactive mechanism of future operational risk management through a Risk and Control Self-Assessment (RCSA) solution, thereby improving the effectiveness of potentially damaging incident prevention. RCSA is considered the “Heart of Operational Risk Management”, connecting the bank’s three lines of defense with preventive operational risk management to prevent operational breakdowns before incidents arise.

Besides the RCSA solution, the project helps complete other Operational Risk Management solutions, including completing the set of rules and regulations for operational risk management; Regulations on Key Risk Indicators (KRI); Regulations on Loss Data Collection (LDC); Regulations on Business Continuity Management (BCM); and Regulations on insurance procurement and operational risk management for outsourcing and new products/ services. Along with building a methodology, HDBank also focuses on using the right tools for each solution and, most importantly, transferring knowledge through training sessions, seminars, and on-the-job training.

In addition to a strong focus on digital transformation, operational risks are also managed through digital technology projects such as the eKYC solution enhancement, fraud and counterfeiting detection, etc., thereby contributing to minimizing risks in the digital journey for opening payment accounts and credit cards online.

HDBank continues to improve concentration risk management in two main operations (in accordance with Circular 13): concentration risk in credit granting and concentration risk in proprietary trading of foreign exchange and bonds, through building and implementing a tightly-controlled risk limit system such as the maximum loan limits for each customer or related customer group, the maximum proportion of lending for each industry/field, and the maximum proportion of proprietary trading for some foreign exchange and bond products, etc.

STRATEGIC DEVELOPMENT GOALS IN THE 2021 - 2025 PERIOD

HDBank’s strategic vision and objectives are to become a leading SME, Retail and Consumer Bank and among the top finance and banking group in Vietnam and Southeast Asia, contributing to the development and integration of global financial markets. Specifically:

DIGITAL BANK

Pioneering in information technology, digital banking development and fintech, etc. with diversified quality and convenient financial products and services, thereby becoming the people’s bank of choice - the Happy Digital Bank.

CONSUMER FINANCE

Turning HD SAISON into a leading consumer finance company, while improving and harnessing the ecosystem of Finance - Aviation - Retails - Consumers - Energy - Telecoms - Real estates with the aim of serving more than 40 million individual and corporate customers in the economy, bringing the highest benefits to shareholders, partners, customers and employees.

GREEN BANK - SUSTAINABLE DEVELOPMENT

Adhering to a development strategy of sustainability, further promoting Green Bank initiatives, contributing to the growth of a Green Economy for a sustainable society, environment, and future development of Vietnam.

GOALS, DIRECTIONS, AND BUSINESS PLAN 2024

The global situation is forecast to remain complex and unpredictable in 2024, with global economic, trade, and investment growth continuing to slow down.

The Vietnamese economy is facing both fundamental advantages and “double negative impacts” from external disadvantages and internal limitations and inadequacies. Opportunities, favorable conditions, and difficulties and challenges are intertwined, but difficulties and challenges are more prevalent, especially in implementing macroeconomic management solutions to control inflation while also promoting growth. However, based on the achievements of 2023, many reputable international organizations have highly appreciated the results and prospects of the Vietnamese economy and forecast that Vietnam will recover quickly in the coming period.

In order to create breakthroughs in its operations, in addition to the foundations achieved in 2023, HDBank will persevere with its strategic goals and continue to maintain its growth rate on a digital platform, strongly deploy and complete strategic initiatives, and overcome the common difficulties of the banking industry to soon become one of the leading banks in Vietnam.

2024 BUSINESS PLAN

Unit: VND billion, %

| Item | 2023 Performance |

2024 Target |

Growth vs 2023 |

|---|---|---|---|

| Total assets | 602,315 | 700,958 | 16% |

| Charter capital | 29,076 | 35,101 | 20.7 |

| Owners’ equity | 46,400 | 56,028 | 21% |

| Total Deposits (*) | 536,641 | 624,474 | 16% |

| In which: Due to customers + Valuable papers issued | 421,716 | 474,681 | 13% |

| Outstanding credit balance (**) | 353,441 | 438,420 | 24% |

| Profit before tax | 13,017 | 15,852 | 22% |

| Profit after tax | 10,336 | 12,601 | 22% |

| ROAE | 24.2% | 24.6% | 2% |

| ROAA | 2.03% | 1.93% | |

| NPL (according to Circular No. 11/2021/TT-NHNN) (***) | 1.32% | ≤ 2% |

(*) Total Deposit includes: borrowing from the Government and the State Bank of Vietnam, due to customers, valuable papers issued, entrusted funds, due to and borrowing from credit institutions.

(**) Outstanding credit balance must not exceed the credit growth limit approved by the State Bank of Vietnam.

(***) Non-performing loan ratio is calculated in accordance with Circular No. 11/2021/TT-NHNN.

HDBANK’S GOALS IN 2024

MEDIUM AND LONG-TERM GOALS AND ORIENTATION

In 2023, HDBank entered the third year of its 5-year strategy (2021-2025) aiming to become the leading profitable bank by 2025. The bank is also working to establish Happy Digital Bank as a national brand and achieve international recognition. HDBank’s strategies focus on the following main goals:

OUTSTANDING MILESTONES AND AWARDS

The Prime Minister’s Certificate of Merit for Outstanding Achievements in the Prevention and Control of the Covid-19 Pandemic; contributing to building socialism and defending the country

Emulation Flag from the State Bank of Vietnam due to its remarkable achievements, leading in the emulation movement of the Banking industry