2024 Business Performance Highlights

Business Performance Overview

With many challenges and difficulties, the year 2024 has concluded a turbulent yet hopeful journey filled with remarkable achievements. HDBank has successfully achieved our business objectives and established ourselves as a strong, secure, and sustainable financial institution that upholds employee benefits while delivering greater value to our customers and partners.

Total assets

0 VND billion

15.8% increase from 2023

- The total assets reached VND 697,366 billion, marking a 15.8% increase from 2023. This helped the bank maintain a high-growth trajectory and rank among the top joint-stock commercial banks in Vietnam by total asset size.

- HDBank’s owner’s equity stood at VND 56,657 billion, with charter capital rising from VND 29,076 billion to VND 35,101 billion through a 20% stock dividend payout in 2023, placing us among one of the top dividend-paying banks in the sector.

- The total credits stood at VND 437,731 billion, representing a 23.85% increase compared to 2023 and 100% completion of the planned target, which aligned with the credit growth target set out by the SBV. HDBank’s credit growth in 2024 is higher than the sector average. The bank’s lending strategy directed credit funding to sectors that are economic growth drivers, including agriculture, rural development, SMEs, supply chain financing, green credit, and tourism.

- Both deposit and credit growth were optimally balanced through various policies and promotions for customers. The total deposits reached VND 621,119 billion, up 15.7% compared to 2023, with deposits from customer deposits and valuable papers growing 23.0% (from 2023) to VND 518,855 billion, exceeding the planned target by 109.3%. This aligned with the credit growth trajectory, ensuring safety and efficiency in capital use and reinforcing HDBank’s market position and customer trust.

profit before tax

0 VND billion

28,5% increase from 2023

- The profit before tax reached VND 16,730 billion, a 28.5% increase from 2023, with net interest income (NII) growing 39% to VND 30,857 billion and net interest margin (NIM) rising from 5.13% in 2023 to 5.58% in 2024. Provision for credit loss (PCL) and operating expenses are appropriately managed.

- ROA and ROE reached 2.04% and 25.7%, respectively, placing HDBank among the top banks in terms of profitability.

- The capital adequacy ratio (CAR, under Basel II standards) was 14.03%, higher than the SBV’s minimum threshold of at least 8%.

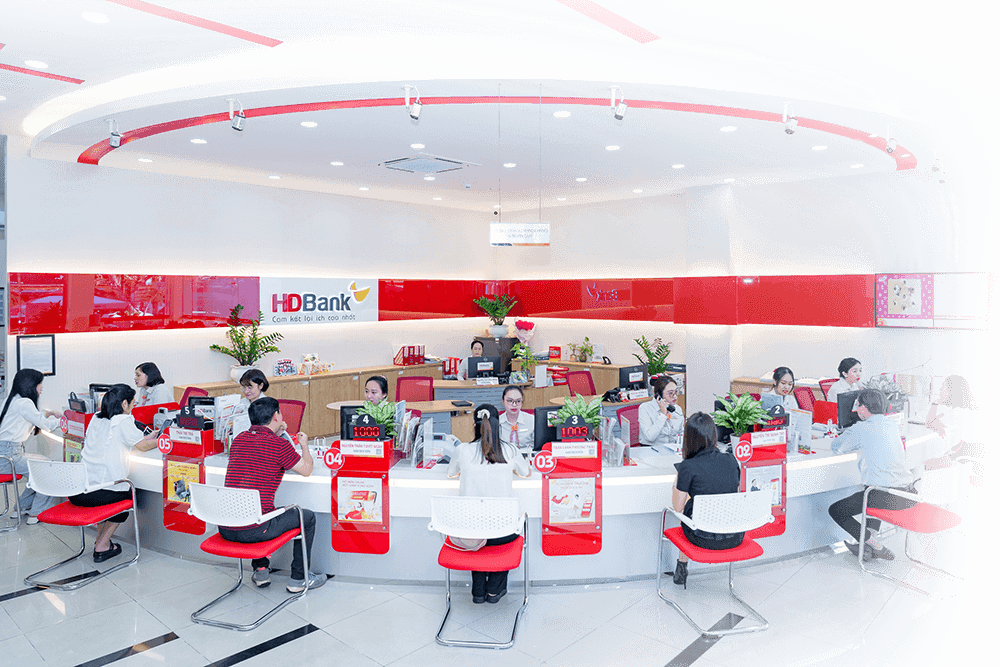

- HDBank now serves more than 20 million customers, with 94% of retail transactions taking place on digital channels, which contributed to 80% of new customer acquisitions. HDBank launched various modern digital offerings that are well received, notably the Vikki Digital Bank.

HDBank has been selected by the Government and the SBV for the transfer of DongA Bank. Not only does this highlight the bank’s strong financial foundation and extensive experience in restructuring projects, but it also creates opportunities for expansion, new business models, and significant value for our shareholders, customers, and partners.

In 2024, HDBank contributed to economic development and sustainability through programs and solutions aimed at easing customer difficulties. These initiatives helped translate the policies and directives of the Government and the SBV into practice, thus promoting socio-economic recovery and development programs. Some notable programs include:

- HDBank actively participated in social programs through a VND 12,000 billion preferential credit package to support customers in northern provinces and cities in restoring production, business operations, and rebuilding after Typhoon No. 3.

- Launched by the Prime Minister, the nationwide program for reducing temporary and dilapidated housing has received a VND 80 billion donation from HDBank and our subsidiaries combined, in the hope of spreading the spirit of community responsibility and solidarity.

Key performance indicators

Unit: VND Billion

| INDICATORS | 2022 | 2023 | 2024 |

|---|---|---|---|

| 1. Capital | |||

|

Chartered capital |

25.303 | 29.076 | 35.101 |

|

Total assets |

416.273 | 602.315 | 697.366 |

|

Capital adequacy ratio (CAR) |

13,4% | 12,6% | 14,0% |

| 2. Business Performance | |||

|

Deposits Mobilization(separate) |

3.442.169 | 4.071.397 | 5.617.198 |

|

Loan Disbursement(separate) |

282.799 | 343.919 | 452.422 |

|

Loan Collection (separate) |

224.660 | 263.619 | 366.646 |

|

Overdue loan |

11.791 | 24.165 | 29.471 |

|

Non-performing loan (NPL) |

4.404 | 6.160 | 8.556 |

|

Capital Efficiency Ratio |

4,36% | 6,75% | 4,69% |

|

Overdue guarantees to total outstanding guarantees balance ratio |

0,02% | 1,94% | 0,12% |

|

Overdue loan to total credit ratio (under SBV's Circular 11/2021/TT-NHNN and Circular 31/2024/TT-NHNN) |

3,40% | 5,18% | 5,07% |

|

Non-performing loan to total credit ratio (under SBV's Circular 11/2021/TT-NHNN and Circular 31/2024/TT-NHNN) |

1,27% | 1,33% | 1,48% |

| 3. Liquidity Ratio | |||

|

Current ratio |

15,2% | 22,47% | 20,10% |

|

Overall liquidity ratio |

61,4% | 87,14% | 79,97% |

Performance Against AGM Objectives

HDBank delivered exceptional high-growth business performance in 2024, achieving or even surpassing the set targets.

Unit: VND billion, %

| Indicators (Consolidated) | December 31, 2023 | December 31, 2024 | 2024 AGM’s planned targets | % 2024 Actual vs Plan |

|---|---|---|---|---|

| Total assets | 602.315 | 697.366 | 700.958 | 99% |

| Charter capital | 29.076 | 35.101 | 35.101 | 100% |

| Total deposits (*) | 536.641 | 621.119 | 624.474 | 99% |

| Including customer deposits and valuable papers | 421.716 | 518.855 | 474.681 | 109% |

| Total credit | 353.441 | 437.731 | 438.420 | 100% |

| Non-performing loans (**) | 1,33% | 1, 48% | ≤ 2% | Đạt |

| Profit before tax | 13.017 | 16.730 | 15.852 | 106% |

| Profit after tax | 10.336 | 13.248 | 12.601 | 105% |

| ROE after tax | 24,2% | 25,7% | 24,6% | 104% |

| ROA after tax | 2,03% | 2,04% | ~2% | Đạt |

(Source: FY2023 and FY2024 audited consolidated financial statements)

(*) Total deposits include borrowings from the Government and the State Bank of Vietnam, customer deposits, valuable papers, trusted investment funds, deposits and lending from credit institutions.

(**) The non-performing loan ratio is calculated in accordance to SBV's Circular 11/2021/TT-NHNN and Circular 31/2024/TT-NHNN.

Project investment and implementation

In 2024, HDBank made several key strategic investments, including:

- HD Securities Corporation (HDS): HDS is now an affiliated company by 29.99% under ownership of HDBank. This investment allows us to expand our financial product portfolio and diversify our investments.

- HD SAISON: HDBank continues to fund HD SAISON, solidifying our long-term commitment to consumer finance.

These investments are part of our annual income and expenditure plan, and are anticipated to drive sustainable growth forward.

Regarding the new headquarter construction project in the Saigon Hi-Tech Park (SHTP), Thu Duc City, HDBank continues to invest in its completion to international standards, featuring modern, energy-saving, and environmentally friendly equipment based on a smart building model. This location will serve as a hub connecting major domestic and international technology enterprises and corporations, aimed at developing modern, feature-rich technology solutions for the finance and banking sector, as well as other industries and fields.

2024 Division Business Report

HDBank’s market standing

Overcoming market fluctuations, HDBank is always among the top banks with the highest and most sustainable growth. The bank has fulfilled its commitments to investors by consistently keeping ROE over 20% since 2018.

Over a decade of driving sustainable development

Over the past 35 years, HDBank has dedicated efforts to building our brand presence. Seven years after our initial public offering (IPO), our remarkable growth has positioned us as a leading bank, recognized for our success in retail banking, focus on agricultural and rural development funding, and pioneering role in the digital era.

Building on our long-standing commitment to ESG, HDBank took the lead to offer green credit in Vietnam and quickly established ourselves as a market leader for the past years.

The year 2024 marks a significant milestone as HDBank continued to strengthen our market position as a pioneer in ESG efficiency. HDBank has established an Environmental and Social Risk Management System (ESRMS) and formed an ESG Committee under the Board of Directors to lead and oversee sustainable development initiatives. HDBank was also a pioneer in issuing an independent Sustainability Report in 2024. Furthermore, in collaboration with PwC, we became the first bank in Vietnam to implement a comprehensive “ESG Governance and Sustainable Finance Advisory” project.

In 2024, HDBank became the first private bank in Vietnam to issue USD 118 million equivalent in green bonds, drawing strong interest from investors. Prior to issuing green bonds, HDBank had already become one of the first banks in Vietnam to introduce a “Sustainable Finance Framework” in alignment with ICMA and LMA standards. This framework was developed with technical assistance from the International Finance Corporation (IFC), a member of the World Bank (WB), and received a “very good” rating from the international credit rating agency Moody’s.

HDBank not only fosters green growth but also mobilizes medium to long-term capital through the issuance of green bonds. These funds are strategically allocated to projects that yield environmental benefits, mitigate CO2 emissions, and contribute to the Government’s objective of achieving carbon neutrality by 2050.

Furthermore, HDBank has consistently ranked among the Top 20 for Best Sustainability Index of the Ho Chi Minh Stock Exchange (HoSE) for six consecutive years and has been highly recognized by international financial institutions such as IFC, DEG, and Proparco for our efforts in climate finance and gender equality.

Pioneering digital culture and business

Prime Minister Pham Minh Chinh and Governor of the State Bank Nguyen Thi Hong visited HDBank's booth at the "Banking Industry Digital Transformation 2024" event.

Looking ahead, HDBank will remain steadfast in our quest for sustainable development, becoming a modern digital bank that actively contributes to the effective implementation of the Banking Sector Development Strategy by 2025, with a Vision to 2030 and the National Digital Transformation Program.

Continuously expanding growth opportunities

As a large commercial bank with 35 years of operational experience marked by safety, efficiency, and extensive expertise in restructuring financial institutions, HDBank has taken on major national initiatives in line with Vietnam’s Communist Party’s and the Government’s vision to contribute to the stability and sustainable development of the banking system.

One of the most significant milestones in HDBank’s growth and ecosystem expansion strategy is taking the transfer of DongA Bank, which brought in long-term value.

Twelve years after the successful merger of DaiA Bank into HDBank in 2013, HDBank once again leveraged M&A as both a core strength and a strategic move to foster synergies.

To achieve this, we will continue leveraging our strengths of extensive network, diversification, and high-quality retail banking offerings rooted in cutting-edge technology to meet customers’ diversifying needs - particularly those in agriculture and rural areas.

Social responsibilities

Our spirit and morale have fueled our continuous efforts to extend love and support to the community, ensuring that no one is left behind while remaining steadfast in our sustainable development strategy.

HDBank accompanied Tuoi Tre Newspaper to donate 3,000 bowls of pho to people in Nu village (Phuc Khanh commune, Bao Yen district, Lao Cai province) - heavily affected by storm Yagi 2024.

Over the past few years, Vietnam’s Communist Party and Government have consistently emphasized that the Happiness Index is one of the key factors for the country’s harmonious and sustainable development. This has been reflected in Vietnam’s rise of twelve places from 77th to 65th in the 2023 United Nations World Happiness Report.

Given this mission, HDBank - “Happy Digital Bank” has brought happiness to customers, employees, and the community through consumer credit, worker preferential loans, social housing partnerships, and personal finance management advisory via cutting-edge technology platforms among others, fostering a happy working environment for our employees.

Recently, HDBank has taken the initiative in fulfilling our social responsibility by supporting customers in business recovery after Typhoon No. 3. This is achieved through a VND 12,000 billion preferential credit package and providing rebuilding aid to people affected by natural disasters in northern provinces and cities. In 2024, HDBank and our subsidiaries contributed VND 80 billion to the nationwide program launched by the Prime Minister for reducing temporary and dilapidated houses.

As part of our expansion plan, we have recruited hundreds of new employees annually, offering them stable jobs and income. With 370 banking branches and transaction offices nationwide, HDBank has become a trusted bank for our customers and the Vietnamese people while making significant contributions to local budgets, fostering economic connectivity, job creation, and local growth and advancement.

2024 is the 8th consecutive year that HDBank has accompanied the Voice of Vietnam (VOV) and the Vietnam Football Federation (VFF) to organize the HDBank Futsal tournaments.

Our spirit and morale have fueled our continuous efforts to extend love and support to the community, ensuring that no one is left behind while remaining steadfast in our sustainable development strategy.

In 2024, HDBank spent VND 43 billion in infrastructure financing (e.g., building charity houses, rural bridges, restoring historical sites, etc.); education sponsorship (e.g., awarding scholarships, upgrading and building schools, offering gifts to the SOS Children’s Villages, etc.); and medical support (free health insurance cards, eye surgeries, dialysis machines, etc.). For nearly two decades, HDBank’s social care programs - such as donating health insurance cards and funding eye surgeries - have become an integral part of our brand in the hope of spreading love and support to those in need.

With a strong spirit of solidarity and care, HDBank employees nationwide regularly organize and participate in charitable activities, such as organizing blood donations, fundraising for disaster-affected communities, visiting elderly people in need, and hosting Mid-Autumn Festival and Children’s Day celebrations for children in remote areas.

The year 2024 marked the 8th year of companionship between HDBank and the Vietnam Futsal League. Along with the success of the HDBank Cup International Chess Tournament of more than a decade since 2011, the remarkable feats of the Futsal League over the past seven years have helped bring Vietnam closer to the international community to provide deeper understanding of our country through chess and football - sports that unite people of all races and cultures.

HDBank also partnered with FPT Corporation to support the Ministry of Finance in resolving network congestion on HoSE. After 3 months, our co-developed system was successfully rolled out, handed over and put into operation seamlessly and securely on July 5, 2021, with a processing capacity 3-5 times greater than the legacy system. With a processing capacity of 3-5 million orders/day, the new trading system would meet the demands of HoSE and the market for at least the next 3-5 years, with HoSE taking ownership over the technology for future scale-ups.

25 prestigious titles and awards are well-deserved recognitions for HDBank in 2024. Among these is the Certificate of Merit by the People’s Committee of Ho Chi Minh City for the bank’s significant contribution to the state budget, marking 6 consecutive years of HDBank’s outstanding contribution to the state budget.

In 2025, HDBank will continue to follow the 2021-2025 strategy to realize the goal of establishing ourselves as the bank for every family, while prioritizing green supply chains and agricultural and rural development in our journey toward sustainable development.

Subsidiary Operation Report

HD SAISON FINANCE COMPANY LIMITED

profit before tax

0 billion VND

83.9% compared to 2023

Amidst a challenging global economic landscape, Vietnam’s economy still demonstrates positive and resilient growth. A recovery in production and business activity, coupled with declining unemployment rates and rising incomes, has bolstered domestic purchasing power. This has fueled growth in the service and retail sectors, opening up significant opportunities for the consumer finance market.

Capitalizing on these dynamics, HD SAISON leveraged our deep market understanding, extensive nationwide network and diversified consumer loan portfolio to sustain our momentum and achieve robust growth in 2024. As of December 31, 2024, HD SAISON’s total assets reached VND 19,648 billion, representing an 11.7% increase compared to 2023. In particular, outstanding customer loans reached VND 18,212 billion, reflecting a 13.2% credit growth. The non-performing loan (NPL) ratio was controlled at 7.4% and the capital adequacy ratio (CAR) stood at 23.4%, ensuring HD SAISON’s balanced approach to effective growth and operational safety.

HD SAISON continued to advance our digitalization strategy, integrating technology for effective management, streamlining operational processes, improving debt collection, mitigating risks, increasing labor productivity, and optimizing costs. In addition to technological application, HD SAISON prioritized developing a highly skilled workforce to drive innovation in business strategies, further enhancing operational efficiency. Driven by robust expansion and strategic cost optimization initiatives, HD SAISON achieved a profit before tax of VND 1,214 billion, up 83.9% compared to 2023, with ROE and ROA reaching 23.7% and 5.2%, respectively.

Outstanding customer loans

Unit: VND billion, %

profit before tax

Unit: VND billion. %

Owner’s equity

Unit: VND billion. %

Management and Governance

There are no member changes in HD SAIGON Members’ Council, Board of Supervisors, and General Director. This has enabled the Company to quickly align our strategy and provide consistent guidance, contributing to business development.

All members of the Members’ Council, Board of Supervisors and General Director of HD SAISON consistently met the standards and requirements prescribed in the Law on Credit Institutions and relevant legal regulations.

Members’ Council

The Members’ Council of HD SAISON is composed of experienced professionals in the banking and finance sector, with extensive leadership experience for years in domestic and international organizations. The Members’ Council consists of the following five members:

- 1 Mr. Kosuke Mori - Chairman of the Members’ Council

- 2 Mdm. Nguyen Thi Phuong Thao - Permanent Vice Chairwoman of the Members’ Council

- 3 Mr. Pham Quoc Thanh - Member of the Members’ Council

- 4 Mr. Koji Sugahara - Member of the Members’ Council

- 5 Mr. Nguyen Huu Nhan - Member of the Members’ Council and General Director

The Members’ Council serves as HD SAISON’s highest decision-making body, operating on the principle of collective deliberation, with decisions approved within our authority by voting at meetings or via written opinions.

With timely and proper guidance and direction of the Members’ Council, along with the determination and efforts of all employees, HD SAISON has achieved many successes in our business operations.

Board of Supervisors

The Board of Supervisors of HD SAISON monitors compliance with legal regulations and the company’s charter in the management and operation by the management and executive officers of the Company. The Board of Supervisors consists of the following three members:

- 1 Mdm. Ho Thu Trang – Chief of the Board of Supervisors

- 2 Mr. Nguyen Xuan Hoang – Executive Member of the Board of Supervisors

- 3 Mr. Takehiko Hayashi – Non-executive Member of the Board of Supervisors

The Board of Supervisors works with management and executive officers in performing assigned functions and responsibilities, particularly in internal audit and monitoring activities. Through these activities, the Board of Supervisors provides recommendations and advice on measures to strengthen internal controls, mitigate risks, ensure compliance with legal regulations, and the Company’s charter and internal policies, enhancing the quality, efficiency and safety of the Company’s operations.

Board of Management

- The Board of Management consists of the General Director and Deputy General Directors.

- The General Director, Mr. Nguyen Huu Nhan, is the legal representative of the Company and is accountable to the Members’ Council and under the law for the daily operations of the Company. The General Director is responsible for managing and making decisions related to the Company’s business-as-usual (BAU) activities in accordance with legal provisions, the Company’s charter and resolutions of the Members’ Council; and monitoring the implementation of Council resolutions.

- The Deputy General Directors assist the General Director in managing one or multiple areas of the Company’s operations, as assigned by the General Director.

The Members’ Council and Board of Management of HD SAISON remain committed to aligning the Company’s development strategy with a long-term and sustainable approach. HD SAISON will continue to implement core tasks, including:

- Spearheading digital technology applications by optimizing automation and artificial intelligence (AI) across all business and operational activities, thereby increasing productivity, minimizing costs, boosting profitability, and expanding the reach of consumer credit across the country, contributing to the enhancement of the material and spiritual living standards, particularly for low- and middle-income individuals.

- Strengthening financial health and governance capacity by focusing on improving financial capacity in terms of scale, quality, and efficiency while ensuring system safety; being committed to doing business operations in an open and transparent manner, adhering to market mechanisms, fully meeting all governance and safety standards of banking operations in accordance with legal regulations and aligning with international best practices.

- Modernizing management practices on the basis of embracing and effectively utilizing advancements from the Fourth Industrial Revolution, ensuring compliance with the Government’s criteria and indicators on digital transformation.

- Developing digital banking services based on a modern core banking system and IT infrastructure with interoperability capability, meeting management and operation requirements, and aligning with HD SAISON’s needs, capabilities and resources; enhancing customer experience and convenience, driving comprehensive financial inclusion and sustainable growth through the application of latest advanced technologies in management, operation and product/service delivery towards process automation and business operation optimization.

HD SECURITIES (HDS)

HDS honored at the ASIA Pacific outstanding brand awards 2024 ceremony

2024 business operations achievements

Key business strategies and achievements in 2024

Unit: VND billion

| Key indicators | 2022 | 2023 | 2024 |

|---|---|---|---|

| Total assets | 4.289,19 | 2.566,95 | 7.686,12 |

| Total Revenue | 1.572,90 | 2.073,08 | 2.220,82 |

| Profit before tax | 453,79 | 249,23 | 674,45 |

| Profit after tax | 360,20 | 194,96 | 536,88 |

The company focuses on five key areas in 2025: Corporate Finance Advisory, Bond Distribution, Securities Brokerage, Capital Investment and Technology Investment. In Corporate Finance Advisory, we aim to increase the total value of securities issued by 33% compared to 2024, with a particular emphasis on promoting public offerings and expanding our client base. For Bond Distribution, we target to increase customer bond holdings by 41% compared to 2024, focusing on expanding our institutional client network. In Securities Brokerage, our objectives include increasing market share and margin balance, while promoting online brokerage to grow our retail customer base and restructure margin debt. The Capital Investment will prioritize investment in holding financial products to optimize returns and expanding proprietary trading in high-quality, large-cap stocks with solid fundamentals. Finally, HD SAISON will significantly invest in technology, including launching version 2.0 of our mobile and web application for customers, and version 1.0 for the sales force, fully automating individual bond transactions, promoting cooperation with SkyJoy, enhancing our fund distribution agent system, and integrating payment and collection services with other banks.

Prestigious awards and recognitions in 2024